Regulation in Fintech - Use case : Rise of fraudulent lending apps in INDIA

Regulations are essential for fundamental institutions in society, such as banking. Each country's government must walk a fine line between too much regulation ( too much bureaucracy and red taping may deter economic growth) and no regulation (could reign in chaos in the society ( depending on the institution )).

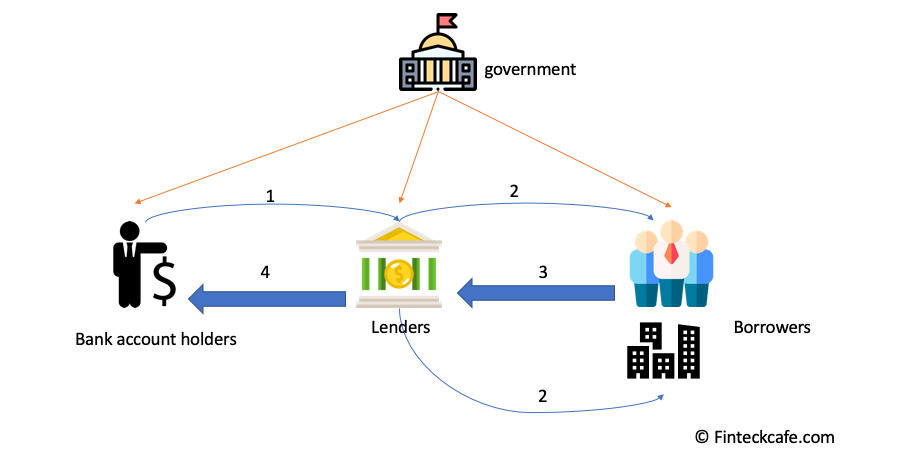

Let's review a simple banking loan model shown below. Hard-working individuals("depositors") in the society save their money in banks (item (1) in the below diagram). For this example, let's assume the banks' savings interest rates at least cover any losses through inflation(let's say the savings interest rate is 2%).

The bank collects all the money deposited in these accounts and lend them to "borrowers"(item (2) in the below diagram). These individuals may be obtaining a loan through personal or mortgage loans. The bank may also be proactively investing in a low-risk investment that provides a higher yield (let us assume the "lending" interest rate is 5% for these loans).

The bank profits from the difference between the interest rates (i.e., savings account deposits and lending (personal loans, mortgage loans, etc.)). Item (3) and item (4) in the below diagram.Banks also profit by charging both "depositors" and "borrowers" with various fees such as loan service fees, overdraft fees, late fees, etc.

Local governments protect all the parties involved in this exchange so that individual actors involved in the transactions don't have an unfair advantage. Society overall feels safe and protected.

Even having good banking and mortgage regulation in the U.S, no one was able to forsee and subvert the subprime crisis in 2008, which brought down the entire global economy. One of the root causes of this crisis is the "predatory lending" practices. The rising housing prices and low-interest rates in the U.S created a very conducive environment for banks to take risk to issue loans which the borrowers could not pay. As soon as the housing prices started to fall and interest rates increased, it created a downward spiral in the economy.

The critical point being there could be blind spots in regulation, which will be exploited by savvy players in the market, and "predatory lending" practices for any loans are bad for the banking system.

Lending Apps in INDIA

The growing middle class, widespread usage of cell phones, and booming tech scene in INDIA make it a viable market for all technologies, including FinTech offering.

India's central bank, Reserve bank of India (RBI), regulates loan lending. Last month RBI issued a press release (Press Release: 2020-2021/819) cautioning its citizen against unauthorized Digital Lending Platforms/Mobile App, which claim to provide loans in a quick and hassle-free manner.RBI also urged individuals to register a complaint against such fraudulent apps.

Google,which powers 98% of India's smartphone, on Jan-14,2021 released a blog post. In summary, stating they have begun a crackdown on fraudulent loan apps in India.

"We have reviewed hundreds of personal loan apps in India, based on flags submitted by users and government agencies. The apps that were found to violate our user safety policies were immediately removed from the Store, and we have asked the developers of the remaining identified apps to demonstrate that they comply with applicable local laws and regulations. Apps that fail to do so will be removed without further notice. In addition, we will continue to assist the law enforcement agencies in their investigation of this issue".Suzanne Frey, Vice President, Product, Android Security and Privacy (src: google blog post)

Google cited two key reasons for crackdown of such apps,

(a) protecting users from deceptive financial products and services: Google has strict rules on loan apps such as disclosure of min and max repayment periods, APR(annual percentage rate), etc.

(b) Protecting user privacy: Google wants to ensure the app developers do not ask for access to personal apps and services on the user's phone.

The loan companies allegedly got access to the personal contact list on the phone. They made calls to everyone on the phone list, creating unwanted trouble for the individual who failed to make repayments.

In this use case, both the country's government body (RBI) and technology platform provider(Google) are working together to enforce regulations and educating people.